Credit Union Cheyenne WY: Customized Financial Services for You

Transform Your Financial Future With Cooperative Credit Union

Credit report unions have actually been acquiring focus as dependable monetary establishments that can favorably impact your financial future. As we check out the numerous ways credit rating unions can assist you attain your economic goals, you'll find just how these institutions stand out in the monetary landscape and why they may be the trick to transforming your future monetary success.

Advantages of Signing Up With a Lending Institution

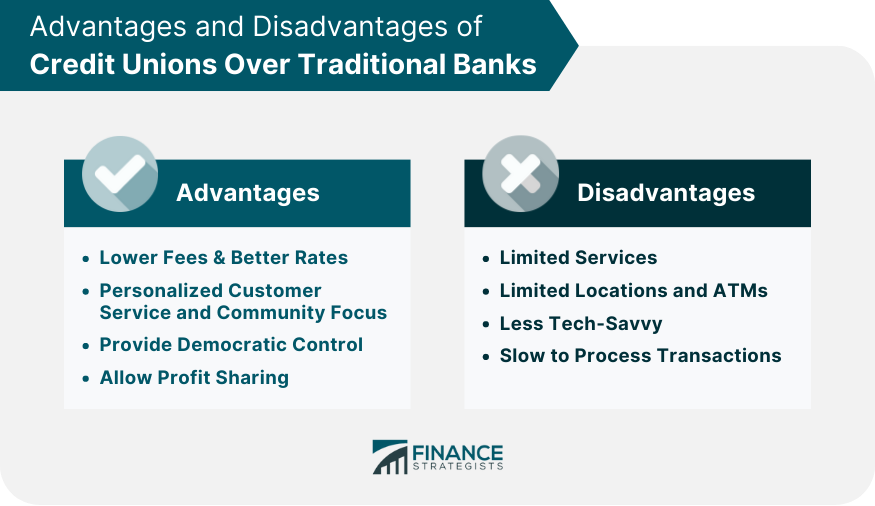

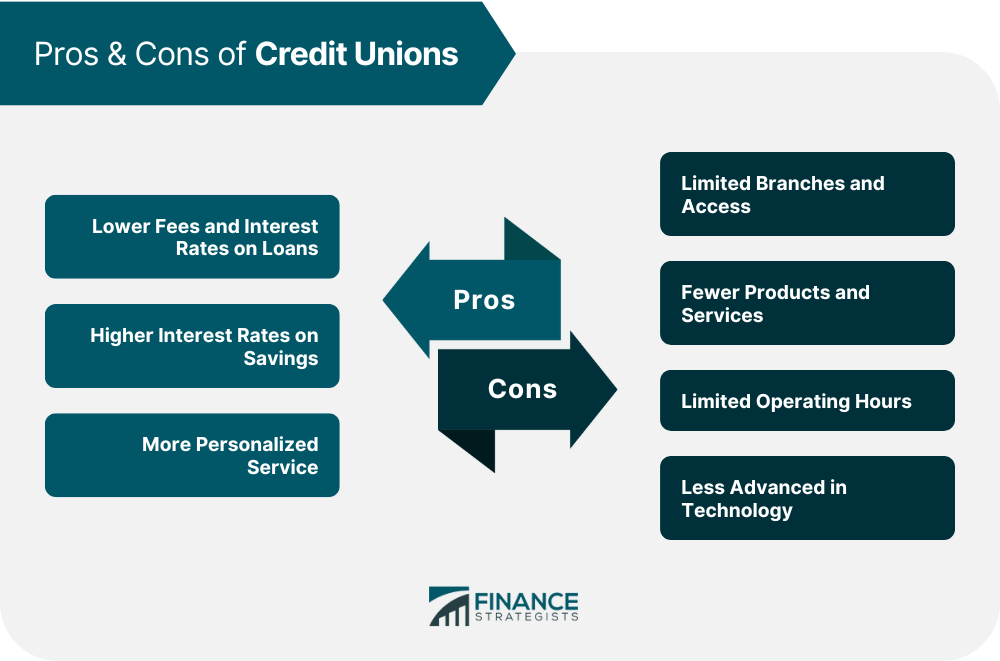

Joining a credit report union supplies countless benefits that can favorably affect your monetary wellness. One of the main benefits is generally lower fees contrasted to conventional banks. Credit rating unions are recognized for having reduced account upkeep charges, lower over-limit fees, and typically lower rate of interest on financings and charge card. Additionally, lending institution are member-owned, not-for-profit banks, which means they are concentrated on serving their participants as opposed to producing profits for investors. This member-centric technique commonly translates into much better customer solution, even more customized focus, and a higher determination to function with members who might be experiencing economic difficulties.

Furthermore, cooperative credit union have a tendency to supply competitive rate of interest on interest-bearing accounts and certificates of deposit. If they were using a conventional financial institution, this can aid members grow their cost savings over time extra effectively than. Numerous lending institution also provide access to monetary education and learning sources, aiding participants boost their financial literacy and make more educated decisions regarding their money. Generally, signing up with a lending institution can be a wise step for individuals wanting to improve their monetary health.

Financial Savings Opportunities for Participants

When thinking about banks that prioritize member benefits and offer advantageous prices and solutions, lending institution stand apart as companies of substantial financial savings chances for their members. Cooperative credit union commonly use higher rate of interest on savings accounts contrasted to conventional financial institutions, enabling participants to gain a lot more on their deposits. In addition, numerous credit unions supply various cost savings products such as deposit slips (CDs) with competitive prices and terms, helping participants expand their savings better.

An additional savings chance cooperative credit union provide is reduced fees. Cooperative credit union are known for charging less and reduced costs than banks, leading to price savings for their members. Whether it's lower account upkeep costs, ATM charges, or overdraft charges, credit rating unions aim to maintain costs minimal, eventually profiting their participants.

In addition, lending institution usually offer monetary education and learning and therapy solutions to aid participants improve their monetary proficiency and make better saving decisions. By using these sources, lending institution empower their members to accomplish their cost savings goals and protect their monetary futures - Credit Union Cheyenne. Overall, cooperative credit union offer a range of cost savings possibilities that can considerably benefit their members' financial well-being

Lending Institution Loans and Rates

Credit report unions' affordable funding offerings and favorable passion rates make them a desirable selection for members seeking monetary assistance. Credit unions supply numerous types of finances, consisting of individual fundings, auto fundings, home mortgages, and credit history cards.

With lower operating prices contrasted to financial institutions, debt unions can pass on the financial savings to their participants in the form of reduced passion rates on financings. Additionally, credit scores unions are known for their tailored technique to financing, taking right into account the person's debt background and monetary circumstance to provide competitive rates customized Continue to their requirements.

Structure Credit With Credit Unions

To develop a strong credit rating and enhance economic standing, dealing with credit scores unions can be a critical and useful technique. Cooperative credit union supply different product or services created to help participants construct credit report responsibly. One essential advantage of making use of credit rating unions for building credit report is their emphasis on customized solution and participant complete satisfaction.

Cooperative credit union typically offer credit-builder financings, secured bank card, and economic education sources to assist members in establishing or repairing their credit score accounts. These items are designed to be much more easily accessible and inexpensive contrasted to those used by typical financial institutions. By making prompt settlements on credit-builder loans or secured charge card, individuals can demonstrate creditworthiness and boost their credit history with time.

In addition, cooperative credit union often take a more all visit natural approach when analyzing credit applications, considering variables past just credit history scores. This can be specifically valuable for people with restricted credit report or previous financial challenges. By partnering with a cooperative credit union and responsibly using their credit-building products, people can lay a strong foundation for a secure economic future.

Planning for a Secure Financial Future

Another trick element of planning for a secure economic future is developing an emergency fund. Setting apart three to 6 months' worth of living expenses in a readily available account can supply a financial safeguard in case of unanticipated events like task loss or medical emergency situations.

Along with conserving for emergencies, it is necessary to consider lasting monetary objectives such as retirement. Adding to retirement accounts like a 401(k) or individual retirement account can help you safeguard your monetary future past your working years.

Verdict

Furthermore, credit scores unions are understood for their customized strategy to financing, taking into account the person's credit report history and financial scenario to offer competitive prices tailored to their needs.To develop a strong credit rating background and boost monetary standing, functioning with credit report unions can be a calculated and helpful strategy. Credit unions supply different products and solutions created to assist participants build credit rating sensibly.Credit history unions usually provide credit-builder finances, protected credit history cards, and economic education sources to assist participants in developing or repairing their credit scores accounts.Additionally, credit score unions typically take an even more alternative strategy when assessing credit history applications, considering elements beyond simply credit rating scores.